Using pro forma templates can save you valuable time when creating your own pro forma income statements. However, like any template, you need to adjust it to suit your needs.

In this guide, you will learn everything you need to know about pro forma financial statements: what they are, how they’re regulated, how they work with financial modeling, how to create them, and the problems with pro forma projections, statements, and sheets. We’ll show you what variables link the three sheets, along with equations, examples, and a sampling of free, downloadable pro forma templates.

Pro forma financial statements present the complete future economic projection of a company or person. Often used to back up a lending or investment proposal, they are issued in a standardized format that includes balance sheets, income statements, and statements of cash flow. “Pro forma” literally means “as a matter of form.” In finance, this matter of form forecasts the future based on the present, using hypothetical budgeting. Pro forma data estimates are built in to show the company’s profits if certain, one-time items are taken out. Anything the company sees as a one-time only expense — or that does not show the company’s representative value — is removed. Instead of tracking the past exactly, such as would be reported in historical income statements, pro forma statements are used to guide big financial decisions, such as the following:

You can also use pro forma statements to do the following:

Used to show company results to investors, pro forma financial statements are often combined with generally accepted accounting principles (GAAP) adjusted statements. Pro forma financial statements are not computed using GAAP and are often called non-GAAP. GAAP-adjusted statements are uniform financial statements guided by rules of the Financial Accounting Standard Board (FASB). They differ from pro forma statements in that they are not projections, but rather historical reports — therefore, they do not consider things like litigation costs, restructuring charges, and other one-time items.

Pro forma analyses are meant to paint a better picture of what is happening with the company, irrespective of one-time events, but considering the specific industry’s standards. In some respects, this type of analysis is a more accurate depiction of the company’s financial health and outlook. Further, organizations may want to develop their pro forma financial statements while they are doing an annual review of their business plan.

The Securities and Exchange Commission (SEC), the United States’ regulator of its stock market, requires pro forma statements with any filing, registration, or proxy statement. They have articles governing the preparation of pro forma financial statements for public companies. These are Regulation S-X Article 11, and Regulation S-X 8-05 for smaller companies from 17 CFR 210. According to the SEC, pro forma financial statements will be prepared for public companies when something happens that the investors should know, such as in the case of an acquisition, jettison of a business, real estate transactions, roll-ups, spin-offs, changes in accounting principles, changes in accounting estimates, or corrections of previously made errors. Additionally, the SEC may require that pro forma financial statements be submitted when a company is filing for an initial public offering (IPO). This is also true of companies that change tax status from a private, nontaxable company to a taxable C-corporation to file for an IPO. The pro forma financial statements, including pro forma earnings per share calculated, must be submitted. Finally, if substantial changes to the firm’s capitalization (the sum of their stock, debt, and retained earnings) are assumed to change substantially after the offering’s close date, pro forma documents must reflect that.

A financial forecast may be used in lieu of pro forma financial statements. According to the SEC, this does not take the place of the pro forma balance sheet, but the pro forma income statement may be withheld. The difference is that the financial forecast details the company’s expected results of operations as a single-point estimate or a range. The legal liability of the company may increase upon submitting forecasts instead of pro forma income statements, but the practice may be more relevant for certain businesses.

Not only does the SEC regulate pro forma statements, but the FASB and the AICPA provide directives, especially when there are major changes in the business structure. To evaluate a new or proposed business structure in pro forma documents, these agencies say that the statements must conform with those of the predecessor business. For businesses that are going public and have to transform into a corporation, the predecessor business may not contain items relevant to a corporation, so the following adjustments must be made:

If a business is acquiring a new business or disposing part of its business, the pro forma statements need to adjust the historical figures to reflect this, and to show, in the case of an acquisition, what a corporation would have looked like separately, but added together. If possible, show a five year projection of the businesses together. There’s no need to include overhead costs. For the effects of the business combination, only show the current and immediately preceding periods.

Since pro forma financial statements and financial projections are quite similar, they may be considered synonymous. However, financial projections can be built from nothing for a startup company, using specific industry-specific assumptions. By contrast, pro forma financial statements are based on current financial statements and change based on events and assumptions. In other words, pro forma financial statements start from real financial data.

Compiled pro forma financial statements can form the basis for calculating financial ratios and financial models, which test assumptions and relationships of your company’s plan. You can use them to study how changes in the price of labor, materials, overhead, and the cost of goods affect the bottom line. Use these models to test the goals of a company’s plan, provide findings that may be understood, and offer better, more accurate data than other methods. New financial models use computer programs that has made this testing better, which enables quick calculation for real-time decision making.

Industries that use pro forma as a concept, whether for financial statements or not, include the following:

Use this Excel pro forma invoice template to create your own pro forma invoices.

Download Pro Forma Invoice Template

Even though pro forma statements are meant to show a more accurate picture of the business’ profitability, there are many ways to manipulate the documents to give a more favorable representation, as there are no universal guidelines for their compilation. The following details are often left out of the pro forma:

Many of the items listed above are part of the GAAP, but not included in pro forma reporting, making it rife for possible deception. This discrepancy is part of the reason the distinction between pro forma and GAAP financial statements is important. Sometimes, in pro forma documents, unsold inventory is even excluded. Not all these things should be left off, but the decisions of what is left off should be well thought out and explained to potential investors, so they have a clear indication of what they are viewing. Knowing how the pro forma documents are compiled and what is left out is also critical when comparing different pro forma statements. Understanding this methodology and the decisions behind it will enable accurate comparisons and information to investors.

Be advised that issuing pro forma financial statements to the public can be problematic, especially since the pro forma statements and the GAAP statements can vary so widely. Investors should be cautious when evaluating these types of statements because they present a considerably more favorable picture of the business.

There are three main documents in pro forma financial statements: balance sheets, income statements, and statements of cash flow. Of the four main financial statements, only the statement of changes in equity is not used in pro forma. Further, the other three main financial statements are amended to project for the specific scenario, making them pro forma.

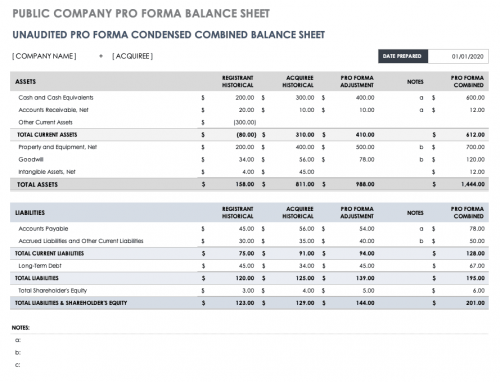

For publicly-held companies, the SEC requires an introductory paragraph showing the proposed transactions, the company, the period covered, and what the pro forma information describes. The SEC also requires the pro forma balance sheet, pro forma income statement(s), and explanatory notes that provide adjustment justifications and pertinent detail. The statement of cash flow is not required. The pro forma financial information should be presented in columns and show the condensed historical amounts, the pro forma adjustments, and the pro forma amounts. GAAP-conforming financial statements must be included with pro forma submissions.

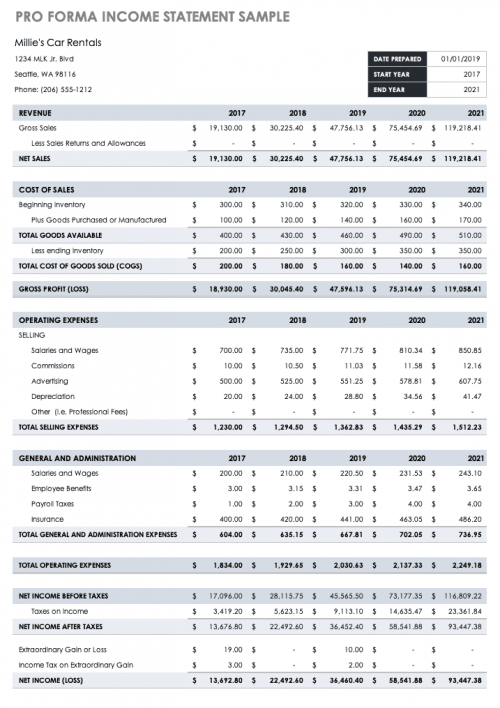

Pro forma income statements, also called pro forma profit and loss (pro forma P&L), are projections based on your past income statements. Regular income statements, sometimes called statement of financial performance, are exacting, in that they reflect the exact income figures your company had in past years. The pro forma income statements considers past data, but its projections reflect the addition or subtraction of events or things. These statements are vulnerable to inaccuracies and changes.

Pro forma income statements usually project a minimum of three years, whereas regular income statements may just be the year prior or based upon a lender’s request. According to the SEC, when required for public companies, pro forma income statements are required for the fiscal year, but not for interim periods. However, for all regular income statements presented in a filing, there must also be a pro forma statement. Use this pro forma income statement template to create your own. This form may also be used for corporate retail or wholesale companies.

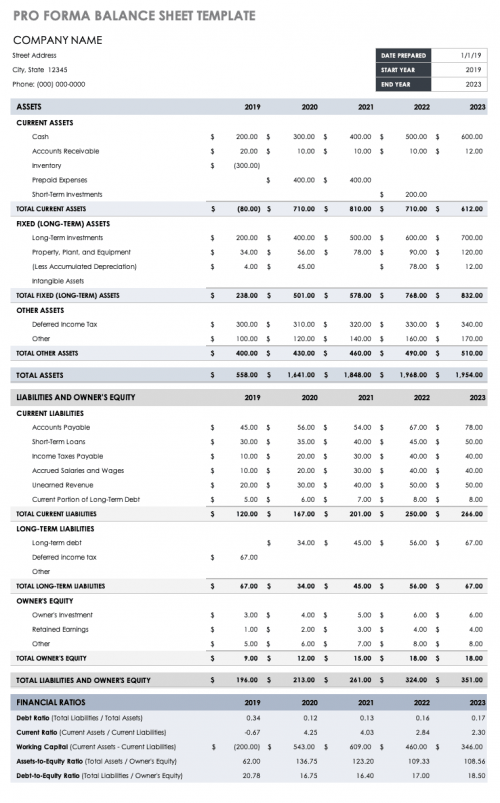

A pro forma balance sheet is a comparison of a business’ assets and liabilities. It provides a snapshot in time of the company’s finances. The pro forma part of the balance sheet is a projection that looks ahead, assuming certain things will occur. Pro forma balance sheets are difficult to compile, but banks generally ask for them and they are important for showing your potential financial picture. They can show the projection of what money will be tied up in receivables, equipment, and inventory. Further, they can represent if your company could run out of money, and how much is necessary to keep it afloat. If your company has a high debt-to-equity ratio, it will show on the balance sheet. Use the balance sheet template below to create your own balance sheet. This pro forma balance sheet can also be used for corporate retail or wholesale businesses.

According to the SEC, for public companies, a pro forma balance sheet should have the same dates, plus one year from the last submitted balance sheet. If interim period balance sheets were submitted, the company should pick up from where they left off. If it is an annual period, the document should also align with the company’s filed GAAP-approved financial statements.

Often, the difference between a past balance sheet and a pro forma balance sheet is that the pro forma balance sheet reports additional periods, sometimes even interim figures. Public companies that prefer to use a condensed combined balance sheet can use this template to create their own condensed balance sheet. A normal balance sheet covers two years, but it is reasonable for a pro forma balance sheet to cover four years of operations.

Download Public Company Pro Forma Balance Sheet Template

Statements of cash flow, or cash flow statements, measure the sources of a company’s cash and how it uses that cash over the stated period. Pro forma statements of cash flow estimate how much cash inflow and outflow is expected in one or more future periods. Often requested by banks, they may also be prepared as a part of the annual budgeting or forecast and estimate where cash shortages may occur in order to obtain additional funding. In the case of estimated cash overages, the company can produce a plan for investment. Arguably, the statement of cash flow is the most important of the pro forma documents. If the pro forma balance sheet and income statements lead to a statement of cash flow that shows inadequate funds for what management has planned, the other documents will be invalid and may need to be reworked.

There are several methods to prepare a pro forma cash flow document, relative to the forecasting periods:

In the annual averages, the figures should not vary significantly. However, the information is affected by outstanding estimated days of sales, or the average number of days that payment has not been made by the customers. The closer the projection is to the actual numbers reported, the more accurate it is. Further, if a company has a stable order backlog, the pro forma statement of cash flow is more accurate. Having knowledge of short-term sales sources help as well. Finally, and regardless of its relative accuracy, a pro forma statement of cash flow forces management to think about the future expected cash flow and whether it is enough.

Use the templates found here to create your own cash flow statement forecast. Change the dates and time periods to reflect the projection you need to create. This form may also be used for corporate retail or wholesale companies.

If your company must produce an introductory paragraph with its pro forma documents, it should describe the content of your pro forma documents. This means that it should define the transaction, the entities involved, and the periods of time. In this paragraph, you should offer a high-level explanation of the limitations and assumptions the pro forma documents were produced under. For example, if your company recently acquired or dispensed with another company, the assumptions would be the changes in finance expected. The limitations should discuss the challenges of predicting the financial future of a company.

The assumptions behind these adjustments should be explained in the explanatory notes, and the explanatory notes should be referenced in the column the adjustment is made. Explanatory notes are used to add explanations or more information in financial documents that explain the content. (These are put into the explanatory notes, or sometimes listed as references, because they would make the main content too long or awkward to read.)

Pro forma earnings per share (EPS) are calculated by dividing a firm’s net income (and any adjustments) by its weighted shares outstanding, plus any new shares issued due to an acquisition. These are changes to the expected results of operations. This metric determines the financial outcomes of any acquisition or merger and tells the parent company whether the transaction will be accretive (good) or dilutive (bad) to the financial state of the company. Pro forma EPS are calculated in the pro forma income statement, but the figure is also used in the pro forma balance sheet and the pro forma cash flow statement, when necessary. According to the SEC, when the dividends from stock exceed or are planned to exceed the current earnings, the EPS must be calculated. The SEC assumes that that proceeds from any additional shares will be used to fund dividends.

When your financial statements are put into pro forma financial statements, you adjust material charges, credits, and tax effects to the transactions. In other words, you get an idea of what your financial results would have been if the event had already occurred. These are factually supported by the data from the original financial statements.

It is important to disclose how the adjustments are made on pro forma financial statements. Below is the guidance that the SEC offers about making the adjustments:

Even public companies are not required to get their pro forma document audited by an independent auditor, according to the SEC. However, to comply with professional auditing standards, the documents can be audited at the request of the company or a third party. The SEC guides auditors to ensure that they do not take on too much responsibility for the company’s claims. Whether in an assurance that the company is financially sound, also known as a comfort letter, or through a compilation letter, the auditor is only responsible for ensuring the financial statements are prepared correctly. The auditor is not responsible for whether the statements are accurate and honestly prepared, but rather to ensure that there are no material errors, such as mathematical errors, oversights, inadequate disclosures, and clerical mistakes. The company’s management is responsible for the documents’ overall validity.

Accountants who prepare companies’ pro forma financial statements are bound by certain requirements, as per the American Institute of Certified Public Accountants (AICPA)’s Statements on Standards for Accounting and Review Services (SSARSs). The SSARSs say that the auditor promises no material modification to the historical financial documents and understands that they are simply showing changes to the company’s financial picture based on a transaction or event using adjustments. They must also ensure they label all pro forma information as such, to avoid confusion with historical information, and list the specific assumptions and uncertainties about them they are making.

The conditions accountants take on include the notation that they may be associated with the statements’ outcomes (so they should consider how the information may be used) and to also submit a compilation report alongside the prepared documents. They are warned that they must have the historical financial information (not just condensed information) alongside their preparation, and that those statements should have been compiled, reviewed, or audited.

To ensure everyone is on the same page, the auditor and the organization’s management should write an understanding of the services being provided. These may include the following:

Use this Word template to create your own compilation report, as per the AICPA’s guidance.

Before an auditor completes a company’s pro forma preparation, they must review the compilation report and consider any material errors and the appropriateness of the reports. Auditors are required to write a compilation report to protect themselves from liability. This report includes the following:

If the accountant is not independent, the report should reflect this. You can address this fact simply with a final paragraph in the compilation reports, and the author may elect to include the reason for the lack of independence. Finally, in each page of the pro forma information, there must be a reference to the compilation report.

To start producing your pro forma financial statements, begin with the pro forma income statement. There is a standard approach called “percent of sales forecasting” that gives you the sales or its growth forecast. From there, project the variables with a stable sales relationship using the forecasted sales and the estimated relations. Generically, the income statement includes the following variables:

Whether you start here or elsewhere, sit down with an income statement from the most recent year. Prior to the end of the year, decide how each item on that statement can or should be changed going forward. The final sales and expenses for the current year should be estimated to get ready a pro forma income statement for the following year. Then, do the following:

To get the pro forma gross profit:

There are other stable variables that aren’t influenced by sales on the income statement, including operating expenses, depreciation and amortization, and interest expense. The COGS figure does directly vary with sales; if it does not, something is wrong with your numbers. The COGS forecast is the COGS/Sales ratio from several years multiplied by the sales forecast.

Below is a sample of a filled out pro forma income statement:

Once your pro forma income statement is completed and you have determined the change in retained earnings, transfer it to the pro forma balance sheet. Expect that the current assets and liabilities will vary directly with the sales variance. For the pro forma balance sheet, the variables include the following:

Assets

Liabilities + Owner’s Equity (Assets – all other liabilities):

Ideally, the pro forma balance sheet is composed in columns. Here are some notes about the pro forma balance sheet variables:

Once you have completed forecasting both your pro forma income statement and your pro forma balance sheet, you can move on to the pro forma statement of cash flow. Start with the beginning balance, or the cash on hand. From there, add total all the cash receipts you have, including the following:

Now, list all the outgoing cash payments. These include adding up all the following, as applicable:

From here, add up all the operating expenses, including the following:

Add any additional expenses together, as applicable:

Finally, calculate your formulas at the bottom of the sheet to get the sums of the analysis. These include Total Cash Payments, Net Cash Change, and Month Ending Cash Position. To calculate each:

The pro forma income statement and the pro forma balance sheet are intimately linked. The pro forma balance sheet and the pro forma income statement must be forecasted together, not separately. The pro forma income statement displays the effect of a given year, while the pro forma balance sheet shows the situation at both the beginning of and time after that year. Between these two forms, the sheet must balance out. Some of the formulas between the two sheets bridge. These include the following:

Some other criteria that cross sheets include the following:

The pro forma income statement equation is:

Change in retained earnings = [Revenue – Operating expenses – Depreciation & Amortization

– (interest bearing debt * interest rate)] * (1- Tax rate) – Dividends

The pro forma balance sheet equation is:

Total assets = accounts payable + wages pay + taxes pay + interest bearing debt + common stock + change in retained earnings

For each of the above equations, the interest-bearing debt is the unknown variable.

Finally, you should link each of your three worksheets together. To do so, make sure you do the following:

In creating your pro forma documents, it is advisable to create multiple sets with different scenarios, especially when their purpose is to help make decisions. In this way, your management team (or C-suite) has all the information they need to make informed decisions. If you enable them, they have the best and worst-case scenarios that review the fiscal impact of their decisions and possible ways to mitigate risk. For more information on conducting risk analyses and the free templates to do so, see “All the Risk Assessment Matrix Templates You Need.” As an example, your team might need to decide between the acquisition of two separate businesses. You could deliver to them two sets of pro forma financial statements, and two risk assessment templates to use to discover their best option.

Download Risk Assessment Matrix Template

There are several other types of templates that could be helpful for a business other than the ones already presented here. There are many different periods that could be covered, as well as the different purposes for the pro forma financial statements.

This projection looks backward (at one or more years) at another company’s financial statements. For the same period(s), it also looks at the business they are acquiring. Using this combination, the projections shows how they would have done together. This calculation gives you the the net acquisition costs. This type of projection could be shorter term (from the beginning of the current fiscal year). Use this free template to create your own historical with acquisition pro forma documents.

For cases in which your company is specifically seeking funding, you want to show your potential investors how the company’s financial results will change with their investment. There may be several sets of these pro forma documents, each based on different potential investment amounts, or just one based on what you think you need. For this projection, you need to determine where in your company the investments would be parlayed. This can be either a fairly simple or complex process. For example, you may be able to add the investment onto the balance sheet under the cash row in the historical with acquisition pro forma template, or you may have to divide the investment under multiple rows. Check the templates in this guide to determine which is right for you to create your own.

There are several terms to relate to pro forma and the finance concepts around it. These include the following:

(the number of shares / the number of shares outstanding) * the total dividend payment

Net cash flow – capital expenditures - dividends

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.